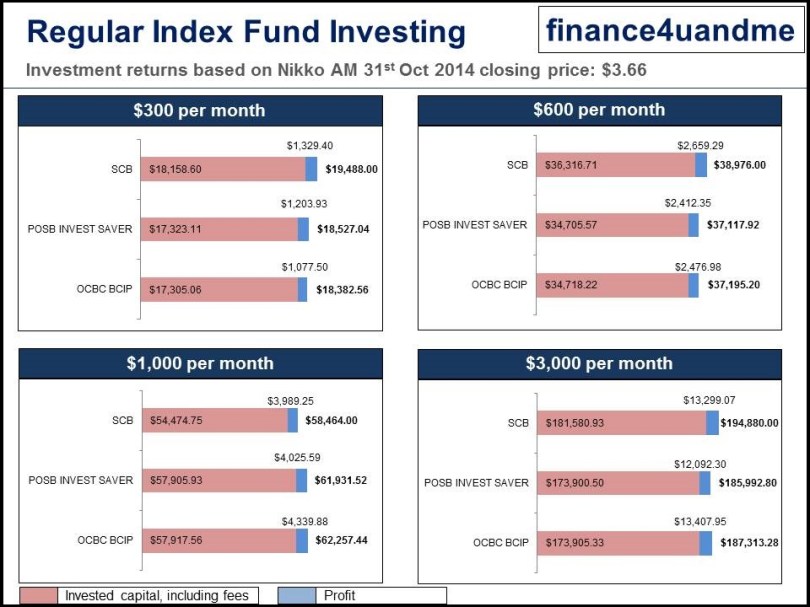

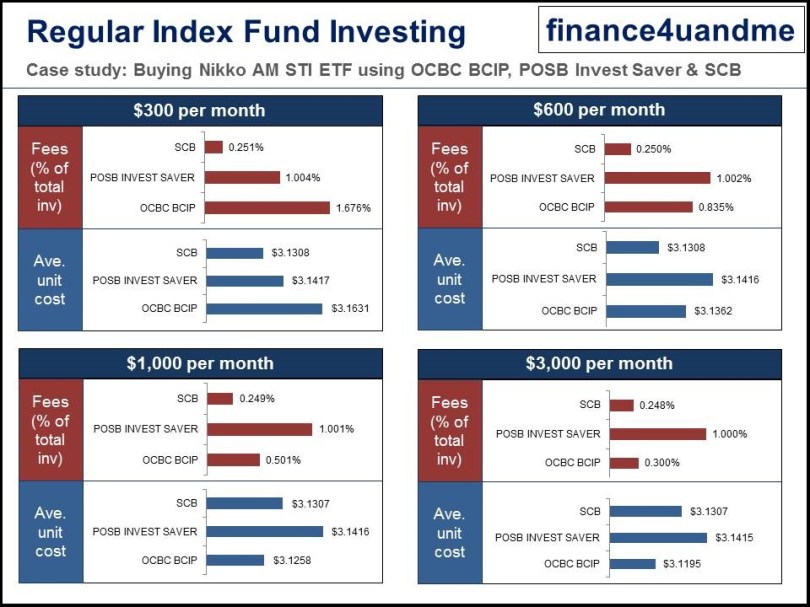

In one of my earlier post (here), I was writing about how to start investing using the dollar-cost averaging method for blue chip stocks and ETFs. I also mentioned about my preference to purchase Nikko AM STI ETF manually using SCB’s online equities trading platform. In this post, actually slides, I will be presenting on the fees and the average unit cost price if one has been diligently investing monthly (ETF purchased at the end of each month) since Jan 2010 to Oct 2014 with various monthly budgets and various platforms. In addition, I also present to you a slide on the returns based of the total investment. (Source data from Yahoo Finance: here)

For my analysis, there are two regular savings plan (RSP), OCBC BCIP and POSB Invest Saver, which purchase shares and the third one is a manual investment via SCB online equities trading platform which purchases shares in lots.

My conclusion (edited on 11th Nov)

POSB Invest Saver (Regular Saving Plan) – Most expensive in terms of fees

OCBC BCIP (Regular Saving Plan) – In between

SCB equity online trading (manual) – Lowest fees.

While SCB equity online trading offers the lowest fees, RSP helps to take one’s emotion out of the equation which I feel is very important.

Please feel free to comment and also share other methods of index fund investing.

Cheers,

Naro

Hi,

Was just wondering why you have not considered the SPDR STI ETF? The fund fees seems to be lower at 0.30% compared to 0.39% for Nikko AM.

There’s also the Phillip Capital Sharebuilder Plan which allows one to DCA into SPDR STI ETF.

Hi 15HWW,

I used Nikko AM STI ETF because its lot size is 100 units and. Come 19th Jan 2015, SPDR STI ETF would definitely be my choice. This analysis was mainly for budget below $1,000, ie myself, to gauge which platform will cost the most in fees.

Philips Capital’s Sharebuilder Plan charges at least a minimum of $6 if it less than one counter and charges 1% fee on dividends. Overall, one’s investment will be lowered from all the fees.

I always welcome suggestions other platforms or modes of DCA.

Cheers,

Naro

Howdy fellow index investor. Awesome post! I will put a link to yours from my blog. At current fees, it is difficult to beat StandChart apart from the fact that it isn’t automated.

Dear Turtle Investor,

Thank you for your comments and putting a link to your blog! Your blog looks good and aesthetically pleasing!!

Actually, in truth, I have not really started on index investing. Am currently contemplating investing for my son for his future education fund. This is the problem with manual index fund investing via the SCB online equities platform.

Cheers,

Naro

Hi naro,

Actually I think the greatest advantage of DCA is that human involvement is reduced to a bare minimum. That is the only thing that prevents an investor from having different returns from the market. If you have to manually buy it yourself for SCB, you might be swayed by market sentiments and start second guessing yourself.

Do I wait a day later to get in cheaper? Do I wait for the bad news to be over? If you don’t trust yourself enough to analysis stocks, how can you trust yourself to be emotionally stable enough to keep buying the index rain or shine?

Not criticizing you, but maybe sharing with you what might happen if you start buying stocks manually for DCA. It might be a risk point that you have to be aware of 🙂 Btw, SPDR pays better dividends in general than Nikko too 😉

Hi LP,

Thank you for popping by my blog!

I totally agree with the emotional portion of DCA. It removes all emotion and it is in auto-pilot mode.

SPDR is good. Just that for the analysis, I used Nikko AM STI ETF which is available on the 3 platforms so that its an equivalent comparison.

Cheers,

Naro